“School holidays” is just another term for spending far too much money or stressing about money more. With the kids home for the whole day, here’s how to ensure they do not eat you out of the house and home.

We have rounded up some ideas and suggestions to help you get through this time.

Affordable things to do with kids during the school holidays

- Malls – local malls will usually have a kids area set up in one of their centre courts where they will have arts and crafts and usually some form of entertainment to keep the kids occupied for a few hours.

- Parks and picnics – we tend to stay inside, but some parks are well cared for. Feeding the ducks and having an outside picnic could just be what the children need to make the school holidays fun.

- Creativity and crafts – download the Pinterest app and find some fun ideas for your children

- Camp out in the garden – this is one of the most fun things to do with kids during the school holidays

- Join your local library - See if they have reading times, or simply take out a few books and enjoy some quiet time exploring the wonderful world of reading.

- Kiddies theatre – see if there is a kiddies theatre in your neighbourhood and join in on the fun.

- Visit the zoo or local museums and give the kids challenges so that they can continue the fun back at home.

- Learn a skill – plant a herb garden, learn how to knit or do woodwork. It can be simple and so satisfying for everyone.

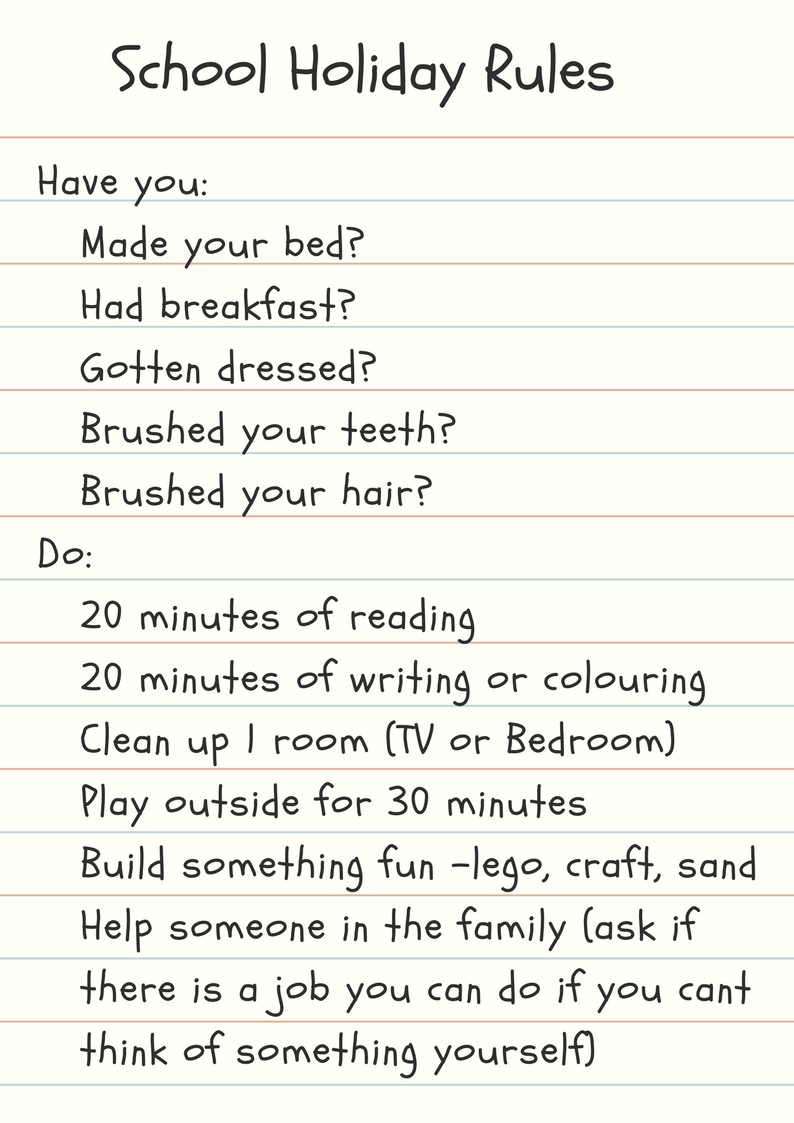

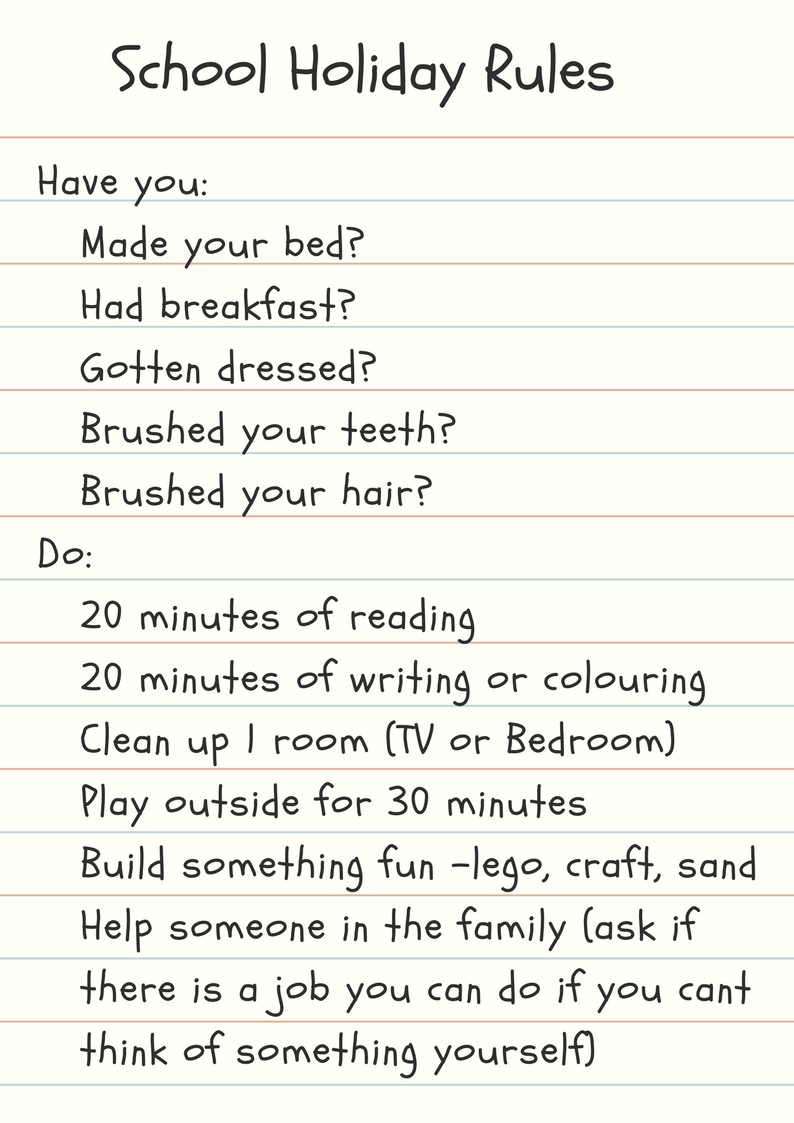

- We all dread the infamous “I’m bored”, so have a daily holiday schedule the kids need to follow before they say they are bored:

Leaving for a holiday? These are the car checks you must do before you depart!